Posted by Natalia Shuhman

The most popular localization languages: Alconost's statistics

In 2021, we at Alconost published data on the most popular languages for product localization. This year, we're continuing the tradition and publishing the latest stats on the demand for languages to enter foreign markets.

An abridged version of this article was first published on the Globalization and Localization Association (GALA)'s website. We thank the association for the opportunity to publish it and for its interest in our content!

In this review, we look at orders made by Alconost Localization Department customers with English as the source language.

People turn to Alconost when launching a product — most often software, an application, or a game — so they can enter foreign markets. The company provides translation and localization services into 100+ languages, video production and multilingual marketing services.

Highlights: 12 Consistently Popular Localization Languages

The 12 most popular target languages for orders that had English as their source language remained the same as last year. French (France), Italian, German, Portuguese (Brazil), Spanish (Spain), Japanese, Korean, Simplified Chinese, Dutch, Turkish, Polish, Russian are languages that are consistently in demand.

Figure 1. The most popular target languages in projects with English as the source language in 2021. The share of orders for the top 12 languages accounts for 63.6% of the total volume of orders.

However, the positions of some languages have changed within the most popular ones compared to last year. Korean, German, and Brazilian ranked higher in the top 12, while Spanish, Dutch, and Turkish ranked lower.

The main surprise in the top 5 is Brazilian Portuguese's rise to 4th place and Spanish dropping out of the top four languages.

Top 5 Languages: The Classic Four + Brazilian Portuguese

There is a group of the four most popular languages for localization — not including English, of course — with the acronym FIGS: French, Italian, German, and Spanish. Just like last year, these languages are among our top 5 languages for localization from English.

When localizing software, apps, and games into the "classic four" languages, developers are able to do more than just enter the markets of four countries. Italian, for example, is the official language in three other countries besides Italy, and German is the official language in five countries outside of Germany. Not to mention the prevalence of Spanish, French, and their variants in dozens of countries on both sides of the Atlantic!

"The availability of a product, not just in English, but in FIGS languages, too, is, in a way, an integral part of software, games, or apps that strive to be global. But we can't forget that translating a product into a particular language and localizing a product for a particular country's market are not the same thing. For example, localization for Spain will not fully meet the expectations of users in Argentina or Mexico. The Spanish language in Latin America has its specifics. You need to adapt the product to the local version of the language in a particular country," says Stas Kharevich, Localization Team Lead at Alconost.

While Spanish's move to fifth place in popularity is a noticeable change in the ranking, it doesn't indicate a global decline in interest in the Spanish language. After all, if we combine the order statistics for all varieties of Spanish (in 2021, we also worked with Spanish for Mexico, the US, Argentina, and Colombia), they would have taken the top spot in our ranking with a share of 8.45%.

If we talk about French, which leads our ranking for the second year in a row now, we mean only the French spoken in France. Note that, for example, Canada, one of the most attractive Francophone countries in terms of marketing, has its own variety of French, and orders for "Canadian French" in our statistics aren't included in the number of French orders for France.

Learn more about the nuances of localization into Canadian French in our review.

Brazilian Portuguese deserves special attention in the top languages. In 2020, it was the "fifth element" in the ranking, on the heels of the classic four. And in 2021, it moved into fourth place and changed the traditional balance of power.

The following factors, we believe, have influenced the growing popularity of Brazilian Portuguese for localization:

Brazil has the ninth-largest economy in the world.

The country has a high purchasing power.

Smartphone and console games are very popular among Brazilians.

The country has one of the highest download rates in Google Play and the App Store.

Indeed, the Brazilian market looks like a tasty tidbit for developers. Considering that Brazil is a growing market for mobile apps and games, we predict that Brazilian Portuguese has a good chance to settle in the top 5 and to be in demand for localization as much as the most popular European languages.

Here's a review of the Brazilian mobile games market and helpful information for those planning to scale their product to Brazil.

Companies that localize into the most popular languages

Among the companies localizing their products into the top languages from our ranking are JetBrains, TransferWise, Avangate, Movavi, and Vizor Games. Bear in mind that these Alconost clients' activities aren't limited to the top 5 languages. As they expand into foreign markets and develop their products, they need to localize into additional languages, and their list is even wider than our top 10.

Japanese, Korean and Chinese are shoulder to shoulder

Just as it was a year ago, Japanese remains the sixth-most-popular language in projects with English as the source language. Although its share among the total number of orders increased by 0.7%, it failed to make it into the top five.

Follow the link for tips on localizing games for the Japanese market.

Please note: The statistics we analyze in this article reflect only "English to Japanese" orders. However, there's another side of this moon: translations from Japanese to English and Asian and European languages.

Ilya Spiridonov, Chief Commercial Officer at Alconost, sheds more light on this:

"For the last year, we've been actively working with clients from Japan. Among the exciting companies from Japan that we started working with in 2021, I would like to mention the game developers Characterbank and Zxima, as well as the tech company RICOH. We expect that we will help more IT and tech companies gain new clients and users from the Asia-Pacific region and the rest of the world in 2022. This March, Alconost was ISO 9001:2015 certified and received two more industry-specific ISO certificates relating directly to translation services. The documented quality of processes will simplify the company's work with corporate clients."

Yoshiyuki Suginome, Regional Director of Alconost Japan and Asia-Pacific, talks about what languages Japanese companies are interested in as target languages and what matters when choosing languages for localization:

"According to our observations, many app developers, from startups to mid-size companies, evaluate the possible impact of localization on ROI efficiency. This potential impact seems to be one of the key factors for specific target languages' selection. As for English, Chinese, Spanish, and Brazilian Portuguese, I guess they're amongst the most popular target languages for Japanese app development companies because of the number of speakers. Apart from that, the cultural and geographical proximity to Japan can factor in. As far as I can tell, this is one of the reasons why Korean, Thai, Malaysian, Indonesian, and Vietnamese are also in demand."

Korean is a popular language for localization, and not just among Japanese customers. It ranks seventh in overall popularity among target languages for orders with English as a source. Over the past year, Korean has jumped three lines up in our ranking: in 2020, its share of 4% earned it tenth place, while in 2021, with a share of 5%, it moved straight to seventh place.

It doesn't come as a surprise if you know the situation in the Korean gaming market. The users from this country are among the most willing to pay in the world, and in 2018, one out of every two(!) citizens of South Korea could be considered a gamer. Given the growing worldwide interest in Korean mass culture, the localization of a product into Korean can no longer be considered something exotic.

Read about the preferences of South Korean users and the specifics of game localization for this market in this review.

Of course, developers aren't ignoring China's audience of more than a billion people. Like last year, between translations into Simplified and Traditional Chinese, developers are more likely to choose the former. Simplified Chinese is eighth in our ranking, just as it was last year.

By the way, if we combined all the varieties of Chinese that we translated from English in 2021 — Simplified Chinese, Traditional Chinese, and the Hong Kong dialect — their share would be 7.3% in total. In this case, translations from English into all varieties of Chinese would be second on our list after French.

Read this article about the issues Chinese developers face when localizing games for users in Western countries.

Places 9-12 and below: What other local markets are popular for localizations

Oddly enough, the 2021 statistics show that the languages of three Asian countries — Japan, Korea, and China — are ranked next to each other. A year earlier, Dutch stood between Japanese and Simplified Chinese. Now, it's moved from 7th to 9th place.

The year before, Turkish was ninth, wedged between Simplified Chinese and Korean. This year, Turkish is tenth, but note that this language has been one of the stable areas for localization from English for several years now. Developers' interest in it can be explained by the fact that the Turkish game market is considered the most developed among Middle Eastern and North African countries. The presence of localization significantly increases the chances of a product's acceptance among users from Turkey.

Turkey is interesting as both a target market and a source one. Their game development industry is booming. Read about the outcomes of Turkish game localizations into popular languages in this case study.

Places 11 and 12, as in 2020, are reserved for Polish and Russian, respectively. The gap between them slightly narrowed over the year. The share of Polish decreased by 0.1%, and the percentage of Russian increased by 0.2%.

Places 13 through 17, in decreasing order of share, are occupied by European Portuguese, Traditional Chinese, Arabic, Mexican Spanish, and Thai. The shares of orders for these languages range from 2.3% to 2%.

Read the review of the Middle East market for localization into Arabic here.

Among the languages gaining popularity specifically for game localization, we'd like to mention Hindi. In 2021, the English-Hindi language pair accounted for 1.3% of orders. We'll see how the situation changes a year from now.

A treat for number geeks: A closer look at the Top 10 localization languages

This section is for those who like to analyze and draw conclusions on their own.

Although the order of languages in the "classic four" (Table 1) has been updated, the gap between the leaders is still within the margin of error.

Table 1. The top five most popular target languages in orders with English as a source in 2021 compared to the top five of 2020:

Top 5 in 2021 | Top 5 in 2020 |

|---|---|

1. French (France), 8.2% of orders with English as the source | 1. French (France), 8.7% of orders with English as the source |

2. Italian, 6.6% | 2. Italian, 6.5% |

3. (↑1) German, 6.4% | 3. Spanish (Spain), 6.3% |

4. (↑1) Portuguese (Brazil), 6% | 4. German, 6.2% |

5. (↓2) Spanish (Spain), 5.9% | 5. Portuguese (Brazil), 5.9% |

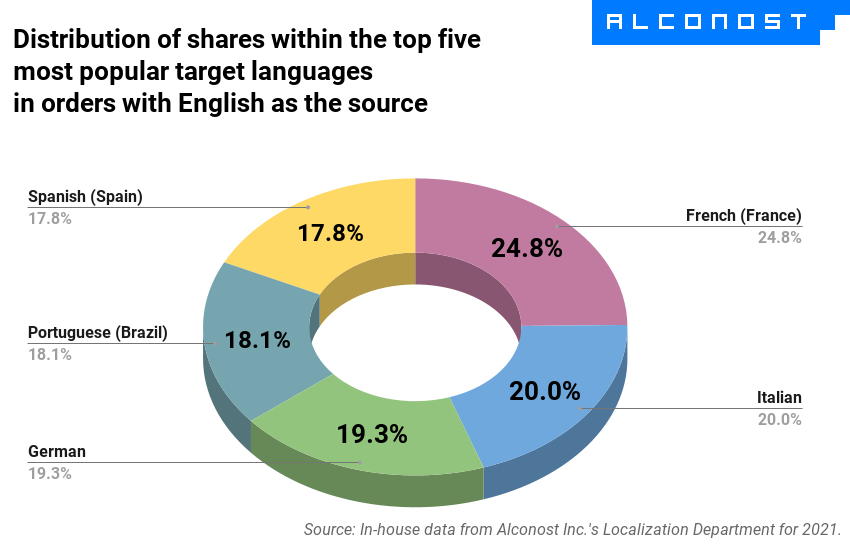

Table 2. Distribution of shares within the top five most popular target languages in orders with English as the source in 2021 compared to 2020:

Top 5 in 2021 | Top 5 in 2020 |

|---|---|

1. French (France), share in the top 5: 24.8% (-0.9%) | 1. French (France), share in the top 5: 25.7% |

2. Italian, share in the top 5: 20% (+0.7%) | 2. Italian, share in the top 5: 19.3% |

3. German, share in the top 5: 19.3% (+0.5%) | 3. Spanish (Spain), share in the top 5: 18.8% |

4. Portuguese (Brazil), share in the top 5: 18.1% (+0.7%) | 4. German, share in the top 5: 18.8% |

5. Spanish (Spain), share in the top 5: 17.8% (-1%) | 5. Portuguese (Brazil), share in the top 5: 17.4% |

Figure 2. Distribution of shares within the top five most popular target languages in projects with English as the source in 2021. See a similar chart with the distribution of shares among the top 5 languages in 2020 in this review.

The gap between the shares of the first and fifth languages has narrowed: in 2020, it was 8.3%, but in 2021, it's now 7%. The distance between the top two languages has also narrowed from 6.4% to 4.8% in a year's time. This reduction indicates a generally balanced demand for all five top languages.

Table 3. Places 6 through 10 of the top ten most popular target languages with English as the source in 2021 compared to 2020:

Places 6 through 10 in 2021 | Places 6 through 10 in 2020 |

|---|---|

6. Japanese, 5.5% of orders | 6. Japanese, 4.8% of orders |

7. (↑3) Korean, 5% of orders | 7. Dutch, 4.7% of orders |

8. Chinese (Simplified), 4.9% of orders | 8. Chinese (Simplified), 4.5% of orders |

9. (↓2) Dutch, 4.4% of orders | 9. Turkish, 4.4% of orders |

10. (↓1) Turkish, 4.2% of orders | 10. Korean, 4% of orders |

The languages in the second half of the top 10 are the same as the year before: Japanese, Dutch, Chinese, Turkish, and Korean. Only their order changed.

But localization isn't everything. So, what else is there?

Here are the services that clients ordered from Alconost's localization department in 2021 for projects where English was the source language.

Over 82% of orders are for localization and translation. Although we combined those two for our review, they are different services. In a nutshell, localization is "translation with an asterisk," i.e., translation with additional conditions, criteria, and requirements. Often, localization is done using a special platform with tools to accelerate the work and improve the quality of the translation and related processes. A localization platform is a must if a project requires consistent terminology and the number of characters per line is limited.

At Alconost, we mostly use the Crowdin platform for localization, and we advise you to do the same. Of course, it's not the only option. Read our review of localization platforms.

For localization and translation, Alconost hires translators whose native language is the project's target language. For example, if an app needs to be localized from English to German, the texts will be translated by a native German speaker. This approach helps make the text sound 100% natural. Imagine, for example, the localization of a game character's lines. To make all the character's speech sound native to the user, the jokes relevant and funny, and the references understandable, it's not enough to just know the language. You have to be a native speaker.

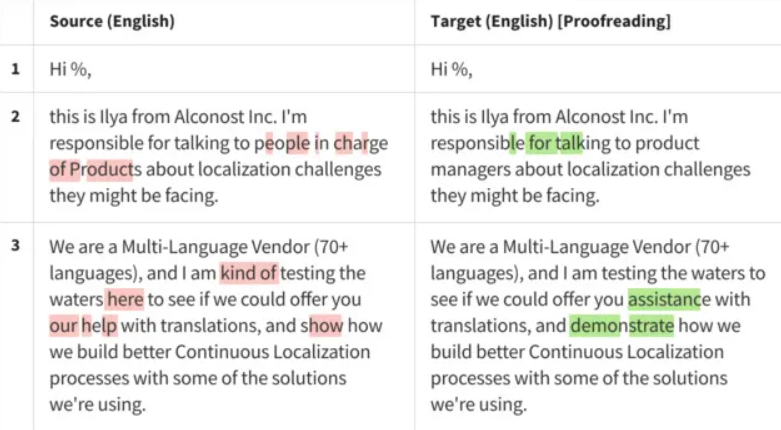

Almost 14% of orders are for proofreading. This includes proofreading text provided by the client and the "second eyes" service when a client orders translation or localization and then has it proofread by a second specialist. Proofreading helps to make the text clearer and easier to read, not to mention correcting misprints and other oversights caused by human error. The screenshot below is a good example of proofreading.

The screenshot shows proofreading in action. On the left is the original text; on the right is the proofread one. The colored marks indicate places where corrections were made.

Among the languages leading the top projects with an English source text, the share of proofreading orders is most noticeable for the languages ranked 9-11 (see Figure 1): Dutch, Turkish, and Polish. On average, the share of proofreading orders in projects with these target languages was 24.1%. The share of proofreading orders in the leading English-French (France) language pair is also relatively high. Almost one in five projects (19.4%) is for proofreading.

Slightly less than 4% are orders for editing, linguistic quality testing (LQT), and custom tasks within a localization project, such as transcribing text for its subsequent translation. Although the proportion of orders for proofreading and LQT is modest, we'll explain when these services are needed.

Editing and localization QA: When you need them

Editing, as opposed to proofreading, involves a more in-depth intervention into the source text. It's most often required for texts resulting from machine translation tools. The most popular languages for which our clients ordered editing in 2021 are English (because the text provided by a client isn't always written by a native speaker), Italian, Japanese, French (France), German, and Spanish (Spain).

"Machine translation is now experiencing a rebirth. Previously, it was done with engines that didn't consider either the text's subject matter, the specifics of translating certain terminology, or translation history. Now there's a new solution: NMT or neural machine translation. Its main advantage is learnability and adaptability. Machine translation using NMT can now consider a text's subject matter, the vocabulary of the subject (glossary), and how certain strings have been translated before (translation memory). But to make NMT a reliable localization assistant, NMT engines must be customizable. Since we at Alconost specialize in IT translations and have localized several thousand niche projects, we have a huge amount of data that can be used to customize the NMT engine and adapt it to a specific niche project. For example, for localizing logic games or financial software. Editing translations performed by a custom NMT engine will go much faster and reduce the cost of translation for the client," says Stas Kharevich, Alconost's Localization Team Lead.

Read more about NMT technology and its prospects in localization in our interview.

Localization QA (quality assurance), or LQT (quality testing), is a service ordered by app and game developers. In contrast to usual software testing to see that everything works properly, LQT checks to see that localized strings are displayed correctly in the product's interface. In 2021, we tested localization from English into Brazilian Portuguese, Russian, French, German, Turkish, and more. Kharevich explains:

"The LQT process detects obvious flaws such as strings that are too long and don't fit into the allocated size of the interface elements, incorrectly displayed unique characters of a particular language, and special cases like the lack of consistency in the naming of the same feature, location, or object. As long as localized strings aren't embedded directly in the interface, it's not easy to spot such errors. In the case of coding, it's simply impossible. It's frustrating when you put so much effort into localizing, and it doesn't have the desired effect on users. This is where LQT comes to the rescue: the entire localization is checked through the eyes of a hypothetical user."

In 2021, we checked the quality of localizations for projects like Melsoft Games' flagship products, for instance. LQT is an integral part of the localization process in this client's projects.

Remember: Every product is different

Our review clarifies which languages developers are most often interested in for English-source projects, but this is only a generalized picture. Taking into account only the statistics of languages' popularity isn't enough. Here are at least 4 other factors developers look at:

Market saturation

Audience purchasing power

The popularity of online payments

The prevalence of specific languages or dialects in the selected country.

To understand which languages you need to choose and what to start localization with, you need to consider the context of your markets, the specifics of your product, your promotion strategy, and key performance measurement metrics.

For example, for inDriver, an international passenger service company, app localization into rare languages and dialects quickly became essential. Among the ten languages inDriver was localized into were Indonesian and Hindi. They're not the most popular according to our statistics, but they're required in the client's strategy.

And it's important not to mistake quantity for quality. If your goal is to maximize the number of installs, you can start with localizing app store descriptions, as well as marketing and advertising content. But if you measure performance with ARPPU (average revenue per paying user), it's logical to assume that the quality and depth of product localization will matter for such users.

Order localization of your product from us

At Alconost, we'll be happy to provide you with a free consultation and a quick preliminary quote. Reach out to us for any localization project you have in mind!

Related articles

Popular articles

How to translate Google Docs professionally and quickly?

Nitro

6 minutes read

Free translation of your app description

Nitro

1 minutes read

Video Localization, Voice Dubbing and Subtitling: Know the Difference

Voice Over

10 minutes read

Latest articles

How to Prepare a Game for Localization? 10 Basic Rules: 2026 Update

Game Localization

BLOG_PAGE.TAGS.newData2026Update

8 minutes read

App & Game Localization: How to Reach Mobile Users Around the World: 2026 Update

Apps localization

Game Localization

Global Markets

BLOG_PAGE.TAGS.newData2026Update

Nitro

11 minutes read

How to Localize a Game Video: Tips, Tricks, and a Checklist for Developers: 2026 Update

Game Localization

BLOG_PAGE.TAGS.newData2026Update

Video Production

14 minutes read

Have a project in mind?

We’d like to learn more about it. In return, we’ll get back to you with a solution and a quote.